So what will happen after that? Wireless carriers will be forced to look for external revenue streams that can augment their current ones, fight to hold on to their customers while do their best to steal customers from others. Pokemon gold cheats gameshark. The Way Out The big two - Verizon and AT&T - know that this day is coming, and they are already hard at work to find alternate revenue streams. AT&T is doubling up its effort to build their GigaPower Network that will allow it to provide high speed fiber-to-the-premises (FTTP) internet connections to households, and Verizon is already a big player in the content market - and now with Yahoo being added to its ranks, it looks more like a conglomerate than a wireless company. If this continues, T-Mobile and Sprint will be left with the job of finding new sources of revenue streams. If they don’t move now, it could be too late. Personally, I think they’ve already crossed that point of no return.

Should I Buy Sprint Stock Today

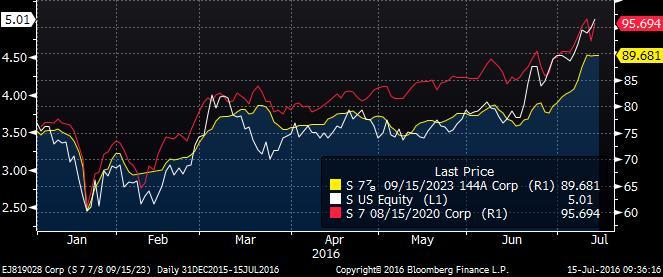

The problem with Sprint - despite them adding a record 173,000 subscribers during the recent quarter and getting postpaid churn down to 1.39% (the lowest level in the company’s history) - is that the company is still making losses. They have been unprofitable for many years, and Softbank’s backing is the only thing that’s allowing the company to stay alive in the highly competitive industry. AT&T and Verizon spent $20 billion and $27.7 billion in capital expenditures, while T-Mobile and Sprint spent $6.6 and $7 billion last year, respectively. Cakewalk pro audio 9 manual pdf. With Sprint’s cash flow being negative for the last few years, it’s not easy to keep re-investing at the pace you would like to. With cost savings measures yielding fruit, Sprint might be expecting to return to being cash flow positive in the next two years if they keep up their subscription growth rate. But the real problem is, how long is the runway?